PRF (RI)

Pasture, Rangeland, Forage (Rainfall Index) Insurance

Overview & Key Points - 2026 Crop Year

December 1st, 2025 sign-up deadline for the 2026 Crop Year (Jan 1. to Dec. 31)

PRF is a federally subsidized option to insure established perennial pasture, rangeland or forage (alfalfa) used to feed livestock (hay or graze) for a single peril - lack of rain

PRF helps to offset additional expenses during dry times for things like:

Additional feed costs - buying hay or other feed

Additional irrigation costs (if irrigated forage)

Costs associated with destocking and depopulating

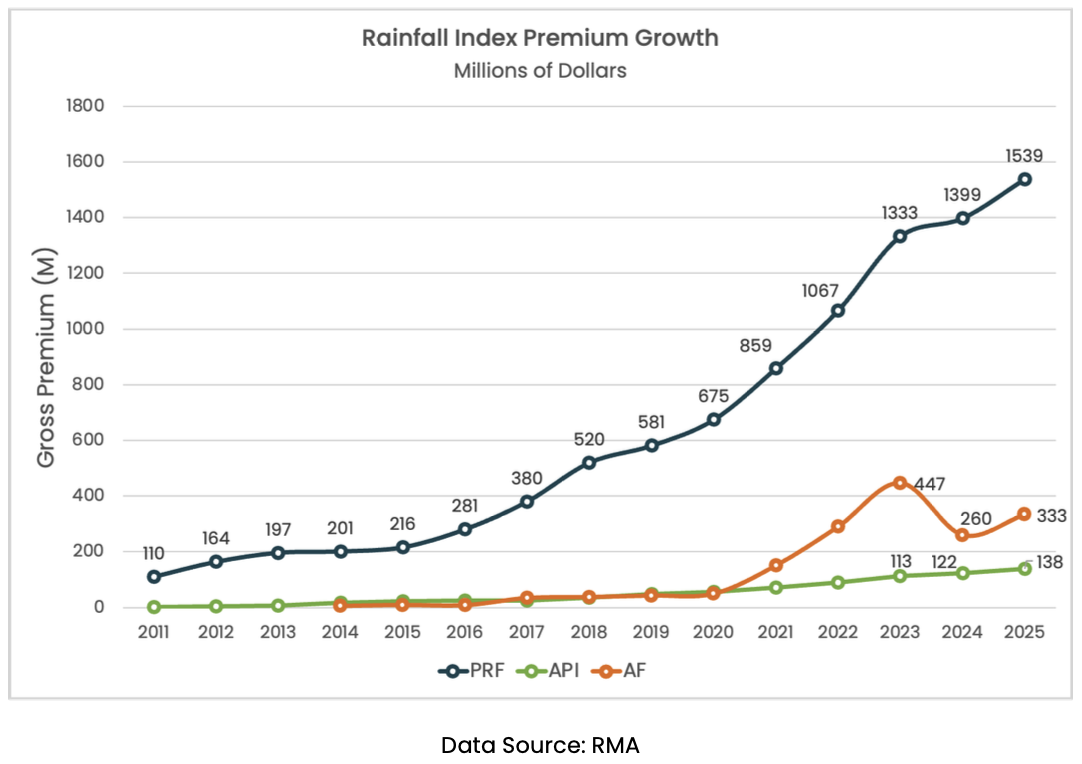

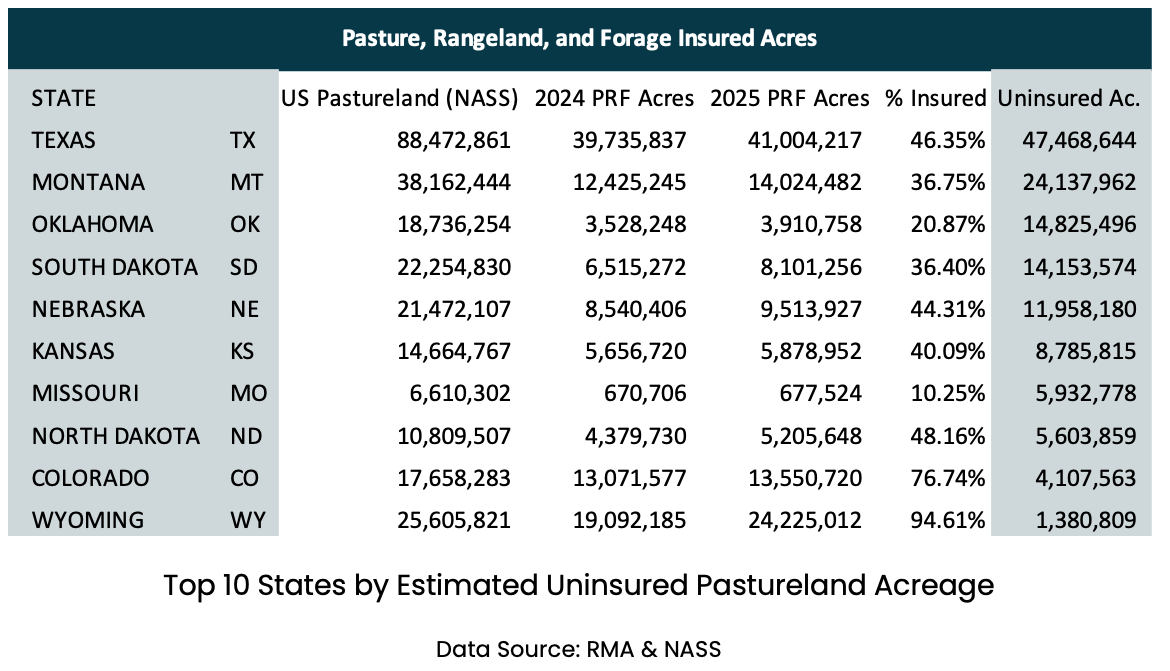

PRF has grown significantly in popularity over the last couple of years - it is now one of the largest commodity insured by a federal program & likely to grow with many more acres eligible

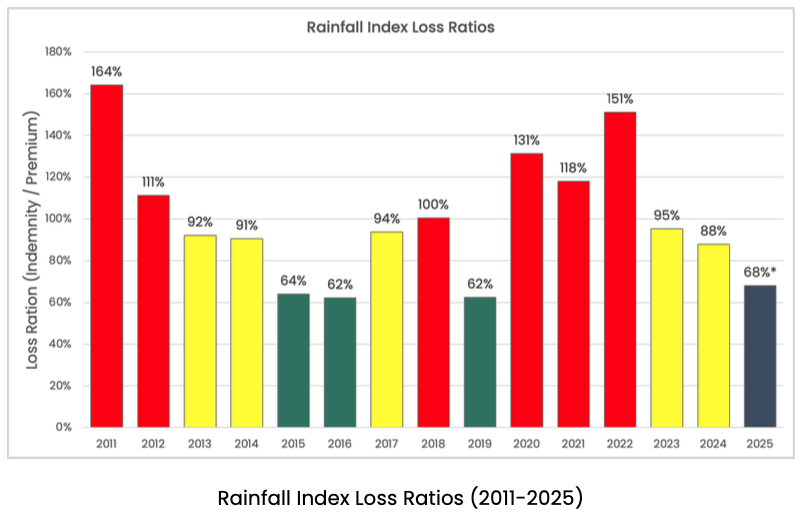

This seems to be driven primarily by the high subsidy rates of over 50% which results in the historical loss payouts being greater than the producers’ premium over time by a fairly wide margin.

Subsidized

55% subsidy at the 85% coverage level

Subsidy rate based on coverage level

Coverage Level (Subsidy) = 70% (59%), 75% (59%), 80% (55%), 85% (55%), 90% (51%)

BFR additional subsidy benefit applies to Margin as well

QUOTE EXAMPLES

Quote parameters:

85% coverage level (55% subsidy), 150% productivity factor

‘Even’ interval periods = FM, AM, JJ, AS, ON = Feb. through Nov.

Grazing - Saunders county (Grid ID 25334):

$70.13 /ac coverage

$4.77 /ac producer premium

Haying NI - Saunders county (Grid ID 25334):

$307.27 /ac coverage

$20.89 /ac producer premium

Based on history, this has a return (ROI) of 189% (almost a 2 to 1 payout)

PRF has such a high payout ratio primarily because of the significant government subsidy

Very Simple

Loss payments are automatically calculated and paid out

No adjuster or claim submission necessary

No production reporting or production history required

You can CUSTOMIZE your coverage by choosing:

Coverage Level: available from 70% to 90%

With the ability to insure at higher levels, like 85 and 90%, you have a smaller deductible than normal, but premiums are still more affordable due to the high federal subsidies.

Intervals: you select which intervals (2 month periods) you want to insure

You have to select at least two intervals (4 months total), but you can select to spread out your coverage over the whole year as well.

Similarly, you can select how much weighting (importance) you want to place on each interval - ex. 40% on May-June and 60% on July-Aug

Max weighting per interval is 60%

Productivity Factor: you select a productivity factor from 60% to 150% to scale up or down the dollar amount of insurance (& premium) to suit your needs / preference.

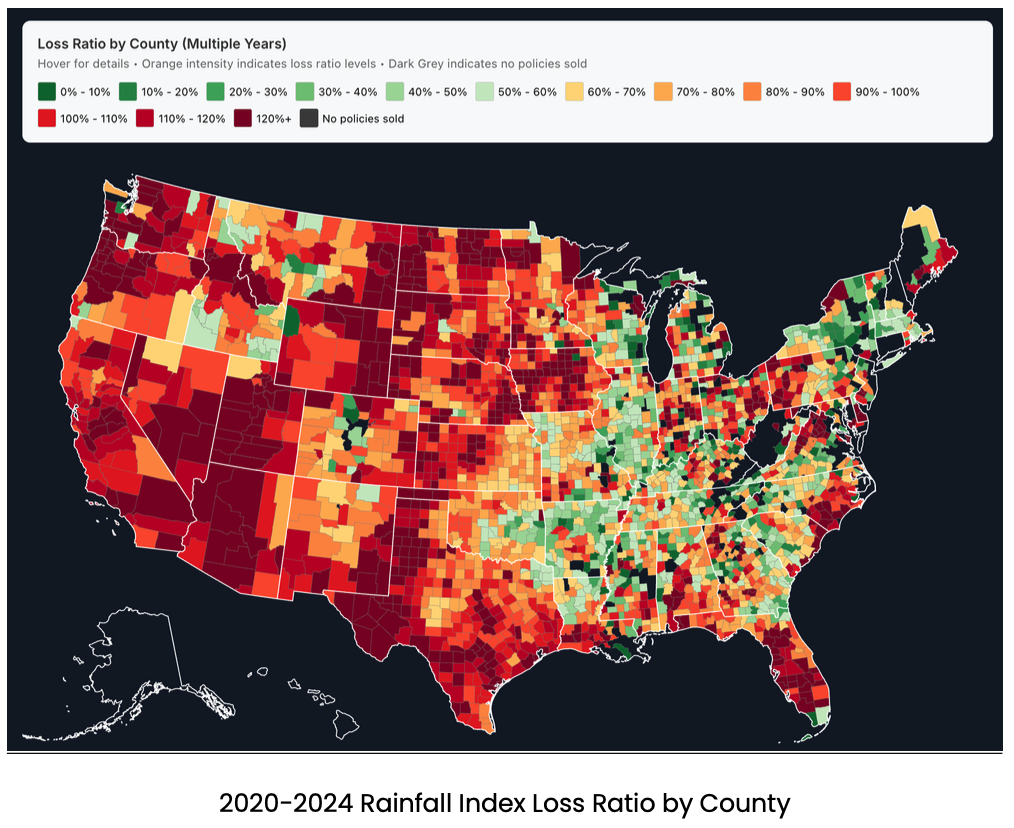

Area plan - based on grids (one grid is approx. 17 miles N/S x 13 miles E/W in Nebraska)

Coverage is based on the experience of the entire grid

It is not based on your own measurement or just your fields

The grid index for precipitation is quantified by NOAA CPC

Rainfall indexes are calculated and based on the normal and deviation from the normal for the years 1948 to the present

PRF key stats, charts and maps

provided by AgencyRoot

Loss Payments

Triggered when the final (actual) grid index < your trigger index

Trigger index = your coverage level X avg. index

Once a period is finished, it takes about 8-10 weeks for NOAA to review, correct & finalize the rainfall data for each grid throughout the nation. Once this process is complete, then FMH automatically files claims and issues loss payments where applicable.

Example: For the Apr-May period, the period finishes at midnight of May 31st and any loss payments due will come around August 1st - 15th.

Loss payments are first applied as credits to premium, and then any remainder and any future loss payments are issued as checks.

Payment calculations

Insured Value per Acre = County Base Value X Coverage Level X Productivity Factor X Insurable Share

Insurance per Interval = Insured Value X Interval % X Acres

Payment Factor = 1 - Final Index / Trigger Index

Interval Payment = Payment Factor X Insurance per Interval

Other Key Points

PRF is NOT drought insurance

Drought classification does not trigger an indemnity

Does not insure against abnormally high temperatures or windy conditions

PRF can be used as a tool to protect against loss of precipitation in key months for forage production

The coverage level selected dictates the amount of precipitation you will be insuring

Example: if the avg. precip. for April-May is 6”, and you select the 90% coverage level, you are effectively insuring 5.4” of precip for your grid.

Newly seeded alfalfa or pasture:

Has to be seeded by July 1st 2024 to be covered for 2025 CY

If ground is both hay and grazed, you can insure as one or the other type - your choice, just can’t insure the same acres twice

Key Dates

Dec. 1st - sign-up deadline (prior to crop year)

Dec. 1st - acreage reporting deadline (prior to crop year)

Sep. 1st, 2026 - premium billing date (i.e. 10 months AFTER sign up deadline)

Jan 1. to Dec. 31 The crop year (coverage period) for PRF is the same as the calendar year

Insurable Interest

Grazing - Must have an insurable interest in the livestock being grazed on the land

Haying - Must have an insurable interest in the hay being produced on the land

You can only insure your share of the insurable interest

Want to Discuss or have Questions?

If you would like to discuss, get a quote or have questions, please contact us - call, text or email.

Last Updated: 11-13-25