ECO, MCO & SCO

Overview & Key Points

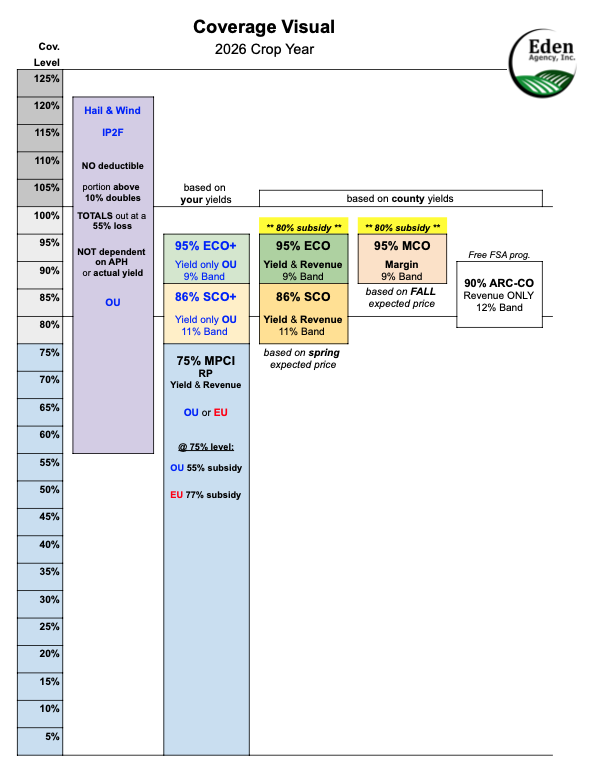

95% ECO - ENHANCED Coverage Option (New in 2021)

95% MCO - MARGIN Coverage Option **NEW in 2026**

86% SCO - SUPPLEMENTAL Coverage Option (New in 2015)

ALL 3 programs are now provided with an 80% subsidy **NEW in 2026**

Subsidy increased for 2026 via the OBBB (One Big Beautiful Bill) & the RMA

The subsidy was 65% in 2025 so the insured paid the remaining 35% - this was a great value

NOW with the 80% subsidy, the insured only has to pay the remaining 20%… this is effectively a 43% discount vs last year and makes the plans an even better value for insureds

ECO, MCO & SCO are all insurance options that are subsidized by the federal government. They can be added to your MPCI policy as an endorsement and used to provide protection against declining crop prices & lower county yields… and MCO adds some protection for increasing input costs

MCO - Overview & Key Points

MCO **NEW option for 2026 crop year**

MCO provides a MARGIN guarantee which provides protection based on the combination of crop prices, county yields and input costs (based on futures for Urea, DAP, Potash, Diesel & Nat Gas)

Margin = Revenue (Price x Yield) - Costs

More likely to trigger a LOSS if one or all of the following occurs:

price decline - if October harvest price is less than its previous fall expected price

yield decline - if actual county yield is lower than the expected county yield

input costs increase - if April futures prices (for Urea, DAP, Potash, etc) are higher than their previous fall expected prices

September 30th, 2025 sign-up deadline for the 2026 Crop Year

95% MCO provides a 9% band of coverage from 95% down to 86%

The expected / projected crop prices for MCO are set early

Provides an “early” 95% guarantee on a 9% band of coverage for the upcoming crop year based on expected prices for crops & inputs that are set in early fall (8-15-25 to 9-14-25 for 2026 crop year).

Expected (projected) Prices - discovery period 8-15-25 to 9-14-25

$4.56 Corn (based on Dec ‘26 futures contract)

$10.73 Soybeans (based on Nov ‘26 futures contract)

MCO vs ECO

You can’t do both - If you sign up for MCO in fall, can’t add ECO in spring

the reason is they are very similar coverage options… see below

Similarities

both provide a 95% coverage level

both provide a 9% band of coverage (from 95% down to 86%)

both offered with an 80% subsidy

both use the same county yields (actual & expected)

both use the same harvest price (October avg).

Differences

different expected prices

MCO - set early in prior fall from mid August to mid September

ECO - set in spring during month of February

This is arguably the main difference and is a key factor in your decision between MCO or ECO

** DECISION => Select 95% MCO now or 95% ECO in the spring (can’t do both) - Main difference is the expected prices…

Do you like the MCO prices ABOVE?

or do you think the February ECO prices will be better?

MCO adds an input cost component

The “M” in MCO stands for Margin

Margin = Revenue (Price x Yield) - Costs

For MCO, the input costs are based on a few select inputs: NPK (Urea, DAP, Potash), Diesel and if irrigated, Natural Gas.

As a result, the MCO cost component is fairly small, roughly $130 /ac on corn and $80 /ac on beans.

In comparison, the revenue component is roughly $800 on corn and $600 /ac on beans… so in the MCO formula, input cost are only about 1/6th as important as the revenue components of price and yield.

Loss Payments

Area Plan - based on COUNTY yields

95% ECO - a loss is triggered once the county yield OR the county revenue drops below 95% of expected, and the max ECO loss is reached once the county yield OR the county revenue drops below 86%

86% SCO - a loss is triggered once the county yield OR the county revenue drops below 86% of expected, and the max SCO loss is reached once the county yield OR the county revenue drops below your MPCI coverage level

If there is a loss, it will be paid out the following summer (approx. mid June)

The reason for the delay is the actual county yield is based on crop insurance data and it is not finalized until mid May

Loss payments are automatically calculated and paid out since not based on your yields or prices - no adjuster or claim submission necessary

If you have RP (Revenue Protection), you are more likely to trigger a loss if one or both of the following happen:

The harvest price decreases (Dec. futures for Corn / Nov. futures for Soybeans)

The harvest yield decreases (actual county yield)

Subsidized

ECO - 80% subsidy ***NEW / increased for 2026 crop year***

Previous: 65% in 2025 and before that was 44% subsidy (51% subsidy if YP)

SCO - 80% subsidy ***NEW / increased for 2026 crop year***

Previous: 65%

BFR additional subsidy benefit applies to SCO & ECO as well

ECO & SCO Similarities

Area Plan - based on COUNTY yields

You could have a loss on your farm, and NOT receive an ECO or SCO payment, or vice-versa

Revenue & Yield Guarantees available

Follows your underlying plan of insurance

Ex. If you have RP MPCI, then if you add ECO or SCO coverage, they will be RP as well

RP provides BOTH revenue & yield guarantees

ARC-CO is revenue ONLY

So when prices are higher like they are now, the ARC-CO yield guarantee is lowered proportionately to keep the revenue only guarantee the same

Prices - both use the same MPCI spring and harvest prices

$4.70 corn, $10.54 soybeans (2025 spring prices)

If you have RP (Revenue Protection) MPCI, which most do, then your ECO or SCO also calculates your revenue guarantee using the higher of the spring or harvest price.

ARC-CO uses prices based on a two year lagging 5 year olympic average (2018-2022)

$5.03 corn, $12.17 soybeans for 2025 crop year

ECO & SCO Differences

Coverage Levels

95% ECO provides coverage from 95% down to 86%

As a result, ECO provides a 9% coverage band

The reason ECO starts at 86% is because that is where SCO starts to provide coverage

86% SCO provides coverage from 86% down to your MPCI coverage level

Ex. If you have 75% MPCI, then SCO provides an 11% band of coverage from 86% down to 75%

MPCI only allows coverage levels up to 85%

ARC / PLC election

For all 3 (MCO, ECO, SCO), it does not matter if you enrolled in ARC-CO or PLC

For SCO, this is NEW for 2026

One or both

You can purchase SCO and not ECO, or vice-versa, or you can purchase both together

March 15th sign-up deadline (same as MPCI)

Links to key websites / documents:

Other Key Points:

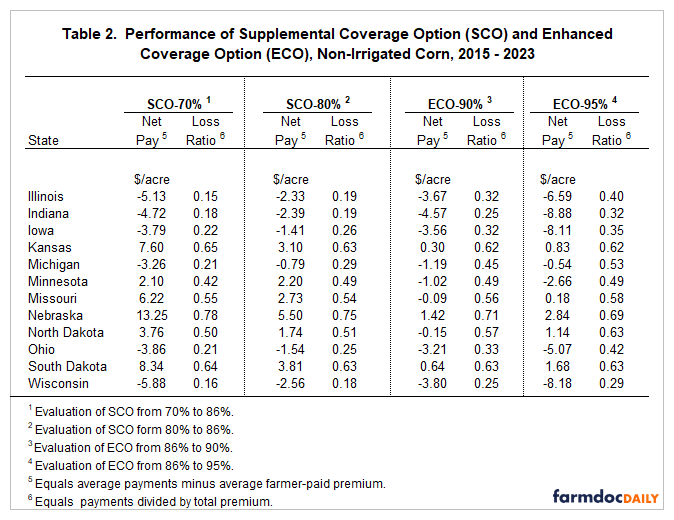

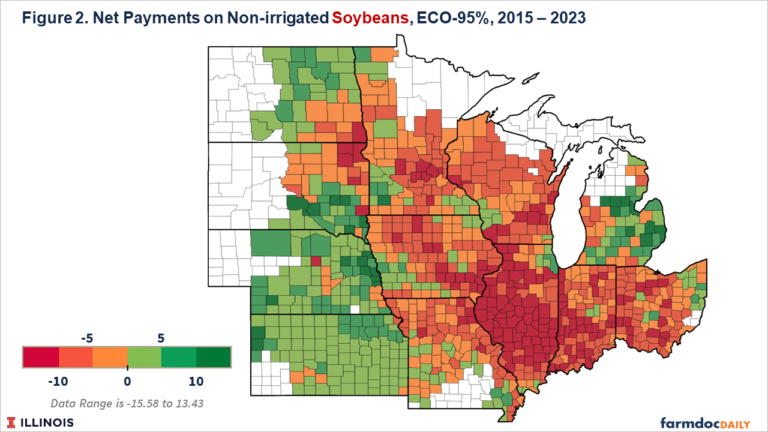

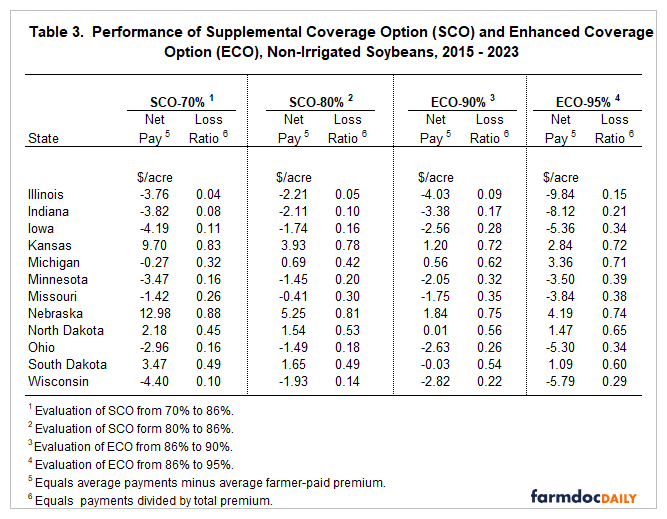

SCO was first made available in 2015

ECO was first made available in 2021

SCO & ECO:

No replant or prevent plant coverage (your underlying MPCI policy already provides this)

Provides county based coverage for a portion of the deductible of your underlying MPCI policy

Coverage is continuous (from year to year) until the endorsement or underlying MPCI policy is cancelled

SCO: if you change your MPCI coverage level, your SCO coverage band will automatically adjust

County Yields

Expected & Actual County yields are based on RMA data collected through the federal crop insurance programs

Coverage Dollar Amount

For both SCO or ECO, your coverage is a function of your APHs (approved yields)

SCO coverage ($ amt) = APH x Price x SCO coverage band x Coverage Factor

Price = higher of spring or harvest price (IF you have RP)

SCO coverage band = 86% - (Your MPCI coverage level)

Ex. If you have 75% MPCI, then SCO coverage band is 11% (86% - 75%).

Coverage Factor: you can select from 50% to 100% to scale up or down the dollar amount of insurance & premium to suit your needs / preference.

ECO coverage ($ amt) = APH x Price x ECO coverage band x Coverage Factor

Price = higher of spring or harvest price (IF you have RP)

ECO coverage band = (90% or 95%) - 86% = 4% or 9%

Coverage Factor: you can select from 50% to 100% to scale up or down the dollar amount of insurance & premium to suit your needs / preference.

Margin Protection (MP)

IF you signed up for Margin Protection (MP) in the fall (9-30-25 sign up deadline for the 2026 Crop Year), then you can NOT purchase ECO or SCO in the spring

MP & ECO similarities

Area plan - based on county yields

Up to 95% coverage levels & same subsidy levels

Same harvest price for corn and beans (set in October)

MP & ECO differences

MP provides some protection against rising input cost; ECO does not

MP projected price set early in Aug-Sep before crop year; ECO projected price set in spring (February) just like MPCI

MP has higher total liability (max payout)

MP = expected revenue x coverage level x protection factor (similar to MPCI RP)

ECO = only a 4% or 9% band of coverage

MP loss payments are REDUCED by any MPCI production loss payments; ECO payments are not

As a result, you can receive a discount on your MP premium that varies based on how much coverage your underlying MPCI policy provides

Last Updated: 9-16-25

Want to Discuss or have Questions?

If you would like to discuss, get a quote or have questions, please contact us - call, text or email.